Spotify: A Broken Business Model?

Whether it’s on your commute to university, during your workout or a house party with mates, most of us can’t do without music in our daily lives. The advent of the MP3 player and the iPod in the past couple decades dramatically increased our consumption of digital music but inevitably gave rise to music piracy. I’m sure many of our readers remember LimeWire, an old, long-forgotten P2P sharing client which provided the masses with a vast collection of pirated music and viruses.

Enter Spotify: a digital music streaming service which came into existence in 2006 and essentially put an end to music piracy while rescuing a stagnating music industry by providing the world with an affordable, legal and easy to use solution for listening to music.

Most of us are probably aware of how Spotify works. But how about from the business side of things?

How Spotify ‘works’

Let’s have a look at the business model Spotify currently uses and see how it works.

What are Spotify’s main sources of revenue?

From a commercial perspective, Spotify is already at a significant disadvantage in terms of the industry it works in. The music industry is monopolised by large record label and distribution companies, with the success of Spotify’s business depending largely on the terms of its negotiations with these label companies as to the share of revenue from music streaming.

Spotify takes a hybrid approach to music streaming by using both a free, ad-supportedversion and a subscription-based premium version. These two versions of its product make up almost the entirety of its revenue stream, with advertising making up around 10% while subscription fees account for almost 90%.

Spotify’s heavy dependence on subscription fees as its main single source of revenue places the business in a difficult position in terms of being able to respond and survive any sudden, unexpected changes to that revenue stream.

"Subscription fees made up almost 90% of revenues"

What are Spotify's main costs?

The biggest cost in Spotify’s books is the royalty fees paid to label companies and their artists. The amount paid is based on a percentage of the number of plays each song gets. In 2015, royalty fees for Spotify took up around 80% of its revenues. This huge cost associated with royalty fees is why many observers believe that the business model for music streaming is broken as music streaming providers are at the mercy of content owners.

What makes the music streaming business so difficult is the high variable costs involved, including the royalty fees as well as bandwidth and streaming costs, which all increase as more people start to use the service.

Given margins are thin enough as it is because of these variable costs, when other essential costs such as marketing, product development, advertising and administrative costs are factored in, the viability of the business looks doubtful.

"Royalty fees took up around 80% of revenues"

Performance Figures

Let’s look at some figures for Spotify’s performance over the past few years.

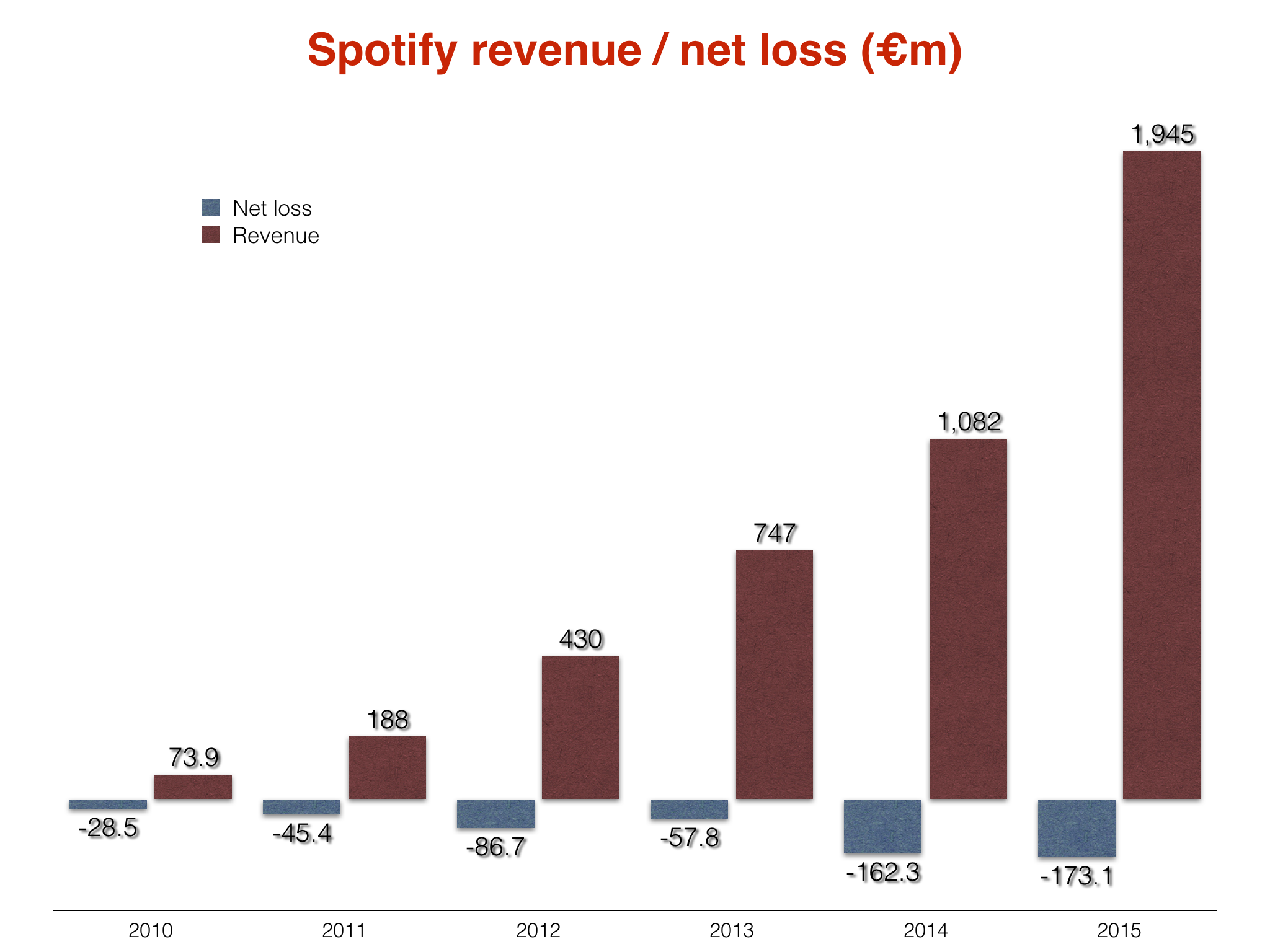

In 2015, revenues increased by almost 80% from €1.1bn ($1.63bn) to €1.95bn ($2.89bn). However, its overall costs also increased by 70% from €1.25 billion ($1.85bn) to €2.13 billion ($3.16bn). The largest source of the cost increase was an 85% jump in the cost of royalty fees.

The figure above highlights the significant handicap music streaming businesses face as Spotify still struggles to make any profit, with a net loss of €173m ($257m) in 2015, worsening by a further 11% from €162m ($240m) in the previous year.

Because of these year on year losses, Spotify has had to resort to funding through debt financing to the amount of $1.5 billion last year, conditional on Spotify going public through an IPO within a one-year time frame.

The Differentiating Factor: Human-Curation on a Mass Scale

Besides the ease of use and its on-demand service,what separates Spotify as a service compared to other music providers is its automatic generation of playlists and curation process. Other streaming services such as Apple Music tout hand-curated playlists selected by individual music curators hired to oversee specific genres and countries.

But Spotify approaches this in a different way by utilising its broad user base to generate playlists for the individual using an algorithm which bases song choices off the playlists of other users. This essentially makes the experience both human-curated for its mass user base but also highly personalised for the individual user.

In addition to this, Spotify also makes use of algorithms and artificial intelligence to scour websites and blogs for the latest, trending music and to make numerous other automatically generated playlists based on geographical location, music genres and different moods.

Spotify's future and risks to its business

Despite its growing revenue, Spotify’s business continues to be dragged down by its massive royalty fees. The sticky nature of the cost of royalty fees means that for Spotify to become profitable in the long run, it must cut costs elsewhere in its business. However, the huge user base of over 100 million active users that Spotify has amassed over the years places them in a favourable bargaining position in relation to the label companies. Based on Spotify’s annual report, the directors hope margins will improve once the unit economics scale with the expansion of the business.

The company also has new products in development, signalled by its recent acquisitions of an audio detection technology company and a blockchain company. But these developments have largely come from its acquisitions of other start-ups, with over eight acquisitions in the past two years alone. While acquisitions may be necessary for further growth, it is a signal for caution as it indicates that Spotify is struggling to find growth within its own business.

The fact remains that despite Spotify’s tremendous growth in the past few years, the company still faces a difficult task ahead, as the music streaming industry becomes increasingly crowded and more competitive with rival streaming services such as Apple Music, Google Play Music and Tidal.

It should be of concern to the directors that the company has had to resort to the use of debt to continue financing its operations, despite the lack of profit to cover interest payments. While Spotify is aware of the dangers ahead and have taken steps to diversify their revenue stream, for example by attempting to break into video and podcasts, the company remains in a precarious position. Spotify’s survival in the long-run will depend largely on its efforts to generate other streams of revenue and scale its costs.

"Spotify remains in a precarious position"